As a locally-owned bank, we know how important it is to support our business community. That's why our business checking and deposit accounts are designed with low rates and free online banking. We keep our business banking services competitive because we believe that through working together we can ensure continued growth for all local businesses, yours included. Bankwest Easy Alerts are available for your mobile personal transaction and savings accounts.

Limited alerts only are available for credit card transactions. Bankwest Easy Alerts will be sent to any compatible iOS and Android device on which you have the Bankwest App and enabled notifications. Bankwest Easy Alerts is currently supported on iOS 11 and Android 5.0 devices and above.

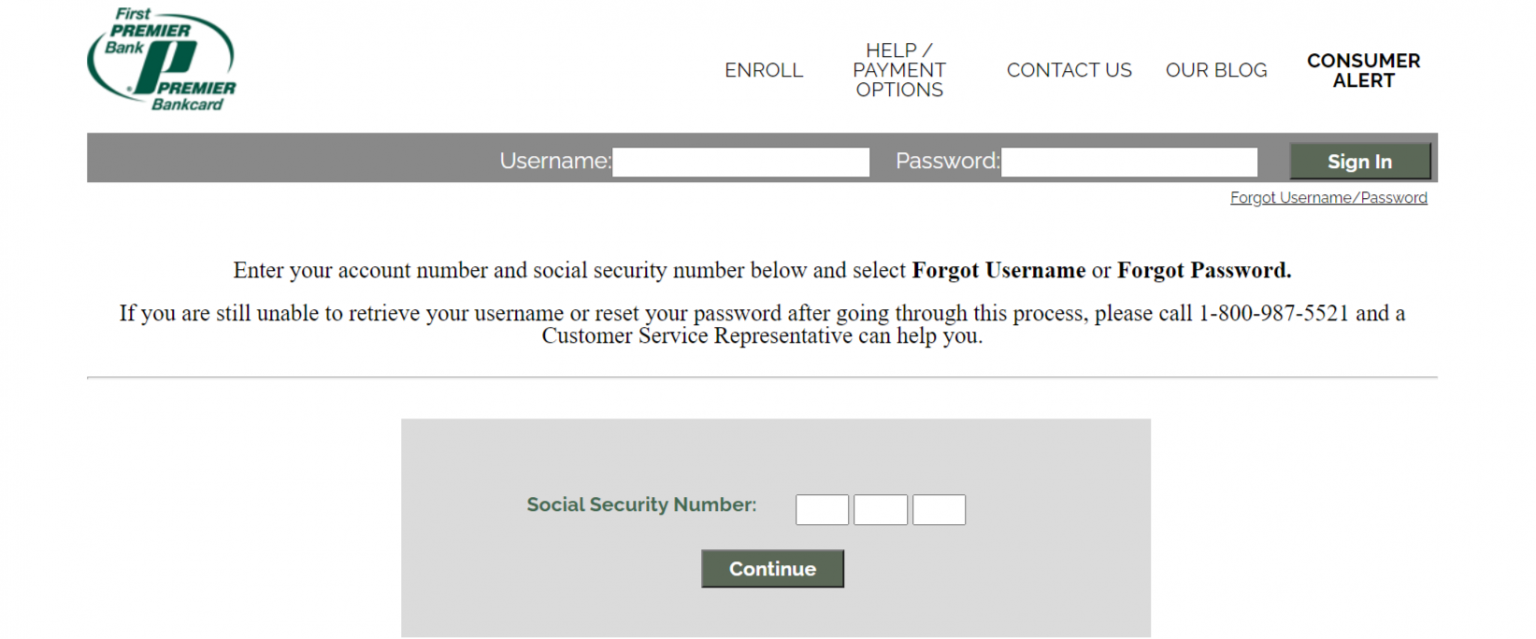

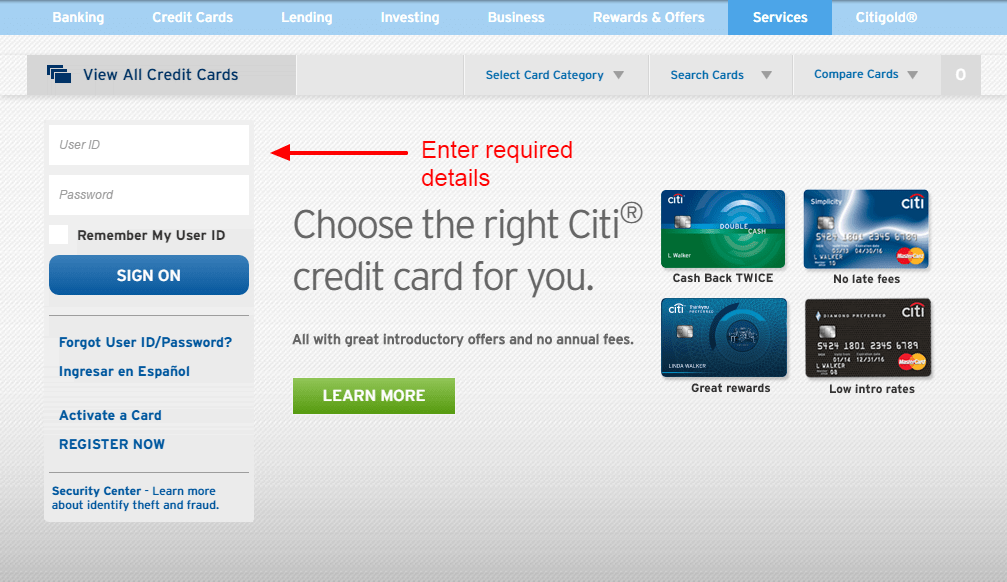

Bankwest Easy Alerts is not available on tablets and Windows devices. This change is now active for both web login through this page as well as logins though the mobile app. We believe that this new process will help us better protect your account information by adding another level of protection against unauthorized access. We also need your help in protecting your account. Please,nevershare your online banking login credentials with anyone, and please do not share any SMS verification codes with a third party. These credentials and codes are only for you, and are meant to protect your account.

Sharing them, for any reason, defeats the protection that they provide. West Point Bank is now offering the fast and convenient access of Zelle® through our online banking and mobile app. With Zelle®, sending and receive money with people you trust is right at your fingertips. We will determine whether an error occurred within 10 business days after we hear from you and will correct any error promptly.

If we need more time, however, we may take up to 45 days to investigate your complaint or question. If we ask you to put your complaint or question in writing and we do not receive it within 10 business days, we may not provisionally credit your account. We offer all the checking and savings accounts of "big banks" without the unnecessary fees or hassle.

We'll take the time to listen to you, and if you ever have a problem, you know where to find us. Plus, you can do your banking whenever you want via our online portal. We invite you to live local, shop local, and bank local with West Point Bank.

Excludes product transfers from existing Bankwest credit cards. You online banking sessions have now become more secure! In order to increase security and provide robust account protection, we have now implemented a multifactor authentication process to your online banking login. Home, Business, or Cell phone--it's up to you. For errors involving new accounts, point-of-sale, or foreign-initiated transactions, we may take up to 90 days to investigate your complaint or question. For new accounts, we may take up to 20 business days to provisionally credit your account for the amount you think is in error.

Routine transactions can be conducted by visting any of our branch drive-thru's, or by utilizing our online banking or mobile app. Bill Pay is now available for consumer online banking users through our website or our convenient mobile app. If you are interested in signing up for Bill Pay, please contact your local Branch office for more information. Get up-to-date-balances on loan and deposit accounts. Perform early or month-end reconciliation of accounts with our current statement and account transaction history.

Export transactions from your West Bank accounts for your Quicken® and QuickBooks® software. Mountain West Bank's online banking is one of the easiest and most convenient ways to do your banking. It's safe, secure and there is no special software to buy or install. You can access your online banking information 24 hours a day; anywhere you have access to the Internet. • Access up to 7 years' worth of checking, savings, CD and credit card account statements online.

Lending and eligibility criteria, and fees and charges apply – including an annual package fee of $395. Available to individuals and eligible family trusts. Package consists of an eligible home loan, one optional eligible credit card per customer and up to nine optional Offset Transaction Accounts per loan.

Plus, there's no annual fee for the first year and no balance transfer fee with the Breeze Mastercard®. Limited time, new Bankwest Breeze Mastercard customers only. See full T&Cs under 'Things you should know'.

Did you know that you can view your account statements online? You can view up to the past 18 months of account statements from within online banking by clicking the "Documents" tab while viewing any account. If you would like to "go paperless" and receive your statements only by electronic means, you can do that too! If you'd like more information regarding eStatements, please contact your local branch office of The Bank of The West. Don't save your password, account number, PIN, answers to secret questions or other such information in an unprotected manner on the mobile device. Consider using a secure password keeper app for this purpose.

Whether you're using the mobile Web or a mobile app, don't let your device automatically log you in or remain connected to financial or sensitive apps or websites. Otherwise, if your phone is lost or stolen, someone will have easier access to your information. Our mobile devices are convenient and are a big part of how we keep in touch with the world.

It makes sense that we now have banking information at our finger tips, 24/7. By now, mobile banking is a pretty common term that most of us hear on a day to day basis. In today's world nothing can be 100% secure from some type of compromise, but the banking industry has taken major steps to make sure that mobile banking apps are secure. The problem often lies with the mobile device and how it connects to internet. Access your credit card account anytime, anywhere, 24 hours a day. How to send a friend money with Person-2-Person payment Learn how to send money to another person directly using our mobile app.

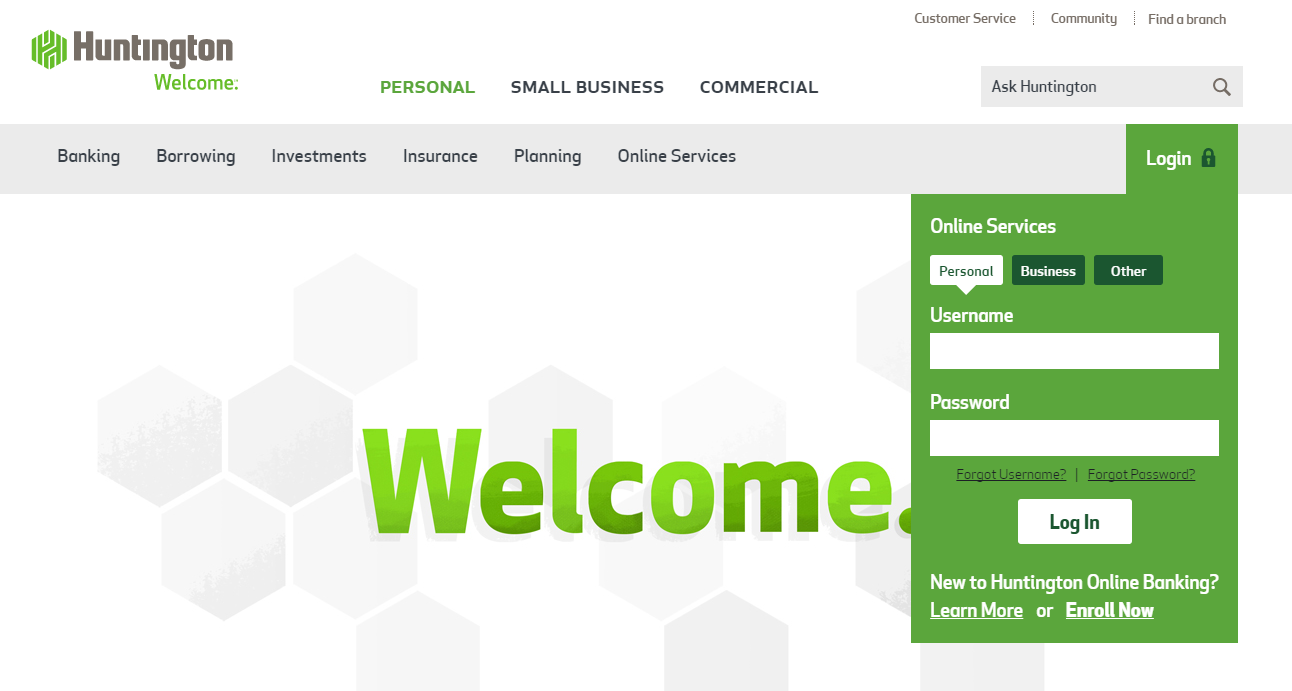

How to sign into Mobile Banking Learn how to sign into our mobile banking app and add an extra layer of security. We offer deposit and loan products to meet all of your personal and business needs. West Union Bank is independently owned and operated by local West Virginians, and provides the same stability offered by larger financial institutions. As a member of TopNet, a cooperative group of noncompeting, locally owned community banks, we work with our peers to ensure a brighter financial future. Our staff also undergoes continuing financial education to be the best that we can be. Paying bills online with Bill Pay is easy and painless – simply set up the vendors you want to pay and enter your payment amount.

You can even skip the hassle of manual payments by setting up recurring charges. Your funds will automatically be deposited into the account of your choice, which takes much less time than cashing a paper check, and leaves you one less errand to run. How to enroll in digital identity protection Learn how to enroll and create your AlwaysChecking profile from our mobile banking app. We will tell you the results within 3 business days after completing our investigation. If we decide that there was no error, we will send you a written explanation.

If we decide no error has occurred, we will take back any provisional credit that was previously issued as a result of the claim. If it is determined that an error has occurred, the credit will become final. Tell us the dollar amount of the suspected error.

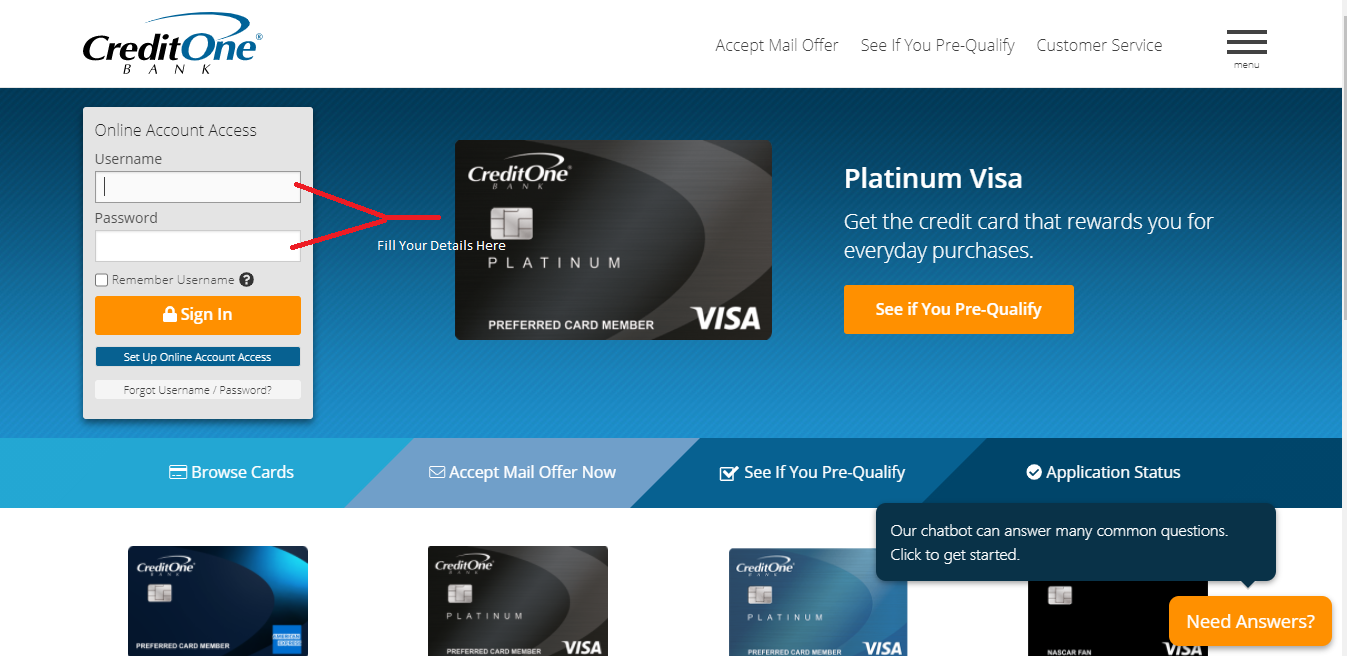

If you tell us orally, we may require that you send us your complaint or question in writing within 10 business days. Online Banking makes your banking experience more convenient than ever. Get a quick overview of your accounts or perform a number of transactions securely online. Register yourself as a new Online Banking user today.

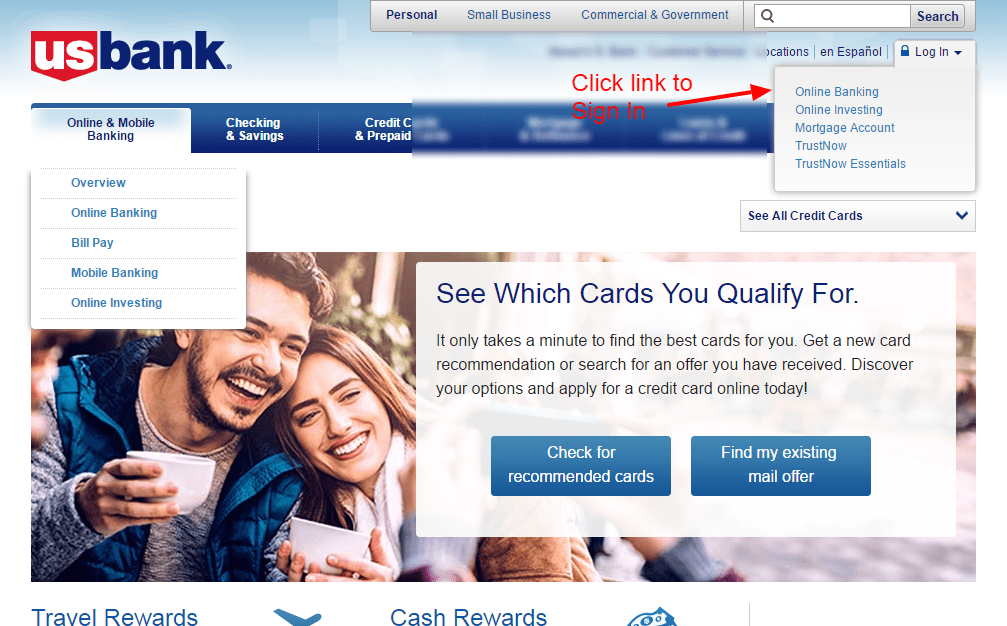

Investment and insurance products and services including annuities are available through U.S. Bancorp Investments, the marketing name for U.S. Bancorp Investments, Inc., member FINRA and SIPC, an investment adviser and a brokerage subsidiary of U.S. The Bank of the West App is available to download at no cost. Your mobile carrier may impose data charges depending on your individual plan. Check with your carrier on specific fees and charges.

This includes operating system updates for your mobile device as well as new app versions. These updates often incorporate security patches to help better protect your device. Changes to your online banking login process are now active. Our commercial bankers are dedicated to finding creative solutions that match your individual situation. Your business is unique and so is our approach to being your bank. We offer local commercial lending decisions with flexible options.

Like your business, we are part of the community. That means we will work to make our relationship successful. Wireless carriers may charge fees for text transmissions or data usage. Message frequency depends on account settings.

Availability of Mobile Banking may be affected by your mobile device's coverage area. Check account balances, transfer funds, pay bills, and get your credit score for free with Credit Insights. The value of investments can go down as well as up, your capital is at risk.

Eligibility criteria, fees and charges apply. Whether you're looking to transfer a balance or travel abroad, our credit cards are designed to suit your lifestyle. Come into a branch and receive a new debit card right on the spot. Need ready cash to make life easier for you and your family? We offer an array of loan products designed to meet the many demands of your personal and professional life.

Bankers' Bank of the West provides first-rate ATM/debit, merchant processing, and credit card programs with built-in flexibility, competitive pricing and high-touch support. Our correspondent lending division functions as an extension of your loan department, enabling you to obtain and keep quality loans for your community bank. You must have a People's United Bank personal checking account to access AlwaysChecking. This latest update offers a new experience for Quick Balance — a helpful feature that lets you see your account activity at a fast glance! Once activated, as a security setting, you'll be able to use this smart feature securely to see balances and recent transactions. Be the master of your money with the Bank of the West app.

Enjoy secure access to your accounts and manage your finances from virtually anywhere. Online banking alerts can help protect your account from fraud. It's a tool that can help you identify the truer cost of a loan. It's calculated using a standard formula that includes the interest rate, as well as certain fees and charges relating to a loan . If you lose your mobile device, IMMEDIATELY tell your bank or mobile operator.

The sooner your report the loss, the better protected you are from fraudulent transactions. Set the device to require a strong password to power on or awake it from sleep mode. If it is lost or stolen, this will make it more difficult to access any personal information stored on the device. For more information on mobile capture, please visit our Tips and Advicepage. If you would like to sign up for mobile deposit capture, please contact your local branch. To apply, you must be a UK resident, 18+ and have an eligible NatWest current account.

We have different current accounts to suit you. Browse our fee-free current accounts, or see the extra benefits you could receive with our range of Reward accounts. Whether it's your first car or a dream home, we're here to fund your future. West Point Bank offers financing for both residential and commercial properties, along with personal loans for cars, boats, furniture and more.

We strive for efficiency so you can get your loan faster and with lower costs. Contact us today to get started with one of our loan officers who will walk you through every step of the way. Open any new personal checking account and get $10. This link takes you to an external website or app, which may have different privacy and security policies than U.S.

We don't own or control the products, services or content found there. Bank National Association, pursuant to separate licenses from Visa U.S.A. Inc., MasterCard International Inc. and American Express. American Express is a federally registered service mark of American Express. From calculators and rate charts to get you started, to experienced loan officers and bankers, U.S. Bank has answers for all your loan and mortgage questions.

Gather important documents, such as financial, insurance or medical records, and store them in a safe, secure location, like a fire- and waterproof safe. Creating electronic, password protected versions of your documents as backups is always another helpful precaution that can give you peace of mind. It's never a bad idea to keep a small amount of cash handy, but remember that your bank is the safest place to store your money. Checking, Savings, and Money Market accounts and CDs are all insured by the FDIC, at up to $250,000, which means that your money is protected. Save money automatically when you use your contactless debit card and enroll for Bank Your Change™.